| ||||||||||||||

| ||||||||||||||

|

|

2.2 - The financial information organization for management control 2.2.1 - Management Accounting The cost accounting and management is aimed at providing information on expenditures, revenues and results, not in a comprehensive way as with financial accounting, but the more disaggregated level in order to satisfy the information needs of each manager . The information will be available on certain segments of the organization, such as products, markets, customers, business, affairs, responsibility centers, among others (Rodrigues e Simões, 2008). The information system of accounting should be based on the information needs of managers, however, will also be responsible for the clearance of the expenses of the products produced (industrial), a task that will reflect the evaluation of inventories which will appear Balance in the organization. According to Rodrigues, J.A. and Simões, A. (2008), the objectives of management accounting can be summarized as follows:

For these objectives can be achieved, the accounting information system of accounting, require several stages of preparation and execution:

2.2.2 - Valuable Objects - Segments Traditionally, business, industrial, allocation of expenses had as main objective the establishment of cost of products. The cost objects were so focused on the allocation of costs (cost centers) to products, manufacturing processes and sections of production (Rodrigues e Simões, 2008). Currently, objects of value left to focus on products or cost centers, going to be guided from the perspective of the market, a multidimensional approach, which allows to analyze the business from various perspectives simultaneously targeting: markets, distribution channels, customers , type of products or services in order to know their sources that may or destructive of value. This change follows the requirement of managers, to monitor the business in its multiple facets, identifying the factors leading to added value and transmit information to its multiple stakeholders (Rodrigues e Simões, 2008). With the developments, valuables began to be called segments. The segments are defined as centers of value analysis, with relevance to continuous monitoring, economic and financial. According to Rodrigues, J.A. and Simões, A. (2008) according to their shape and definition, the segments can be considered:

"The segment can then be understood as any part of a company or group of companies, of which it considers relevant knowledge of economic and financial information, namely the identification of costs, results and capital that will require in its normal operation (economic activity). Examples of segments:

To be able to meet the financial performance by segment, you need to guide the management accounts for this purpose. The profitability of customers, the value generated by a project for a distribution channel, or the contribution of a center of responsibility, must therefore be the key concerns of accounting, which will be required to define a more demanding and comprehensive in terms of collecting, processing and dissemination of information. Traditional models of management accounting have proven more oriented towards the establishment of spending, mainly in the internal logic and not on external logic of the market. Knowing the value generated by each segment of the organization, will certainly contribute to more efficient management by giving managers greater certainty in their decisions (Jordan et al., 2007). The choice of segments to be adopted should reflect the company's strategic options (segmentation of customers, products, markets, organizational structure, among others), as well as the power of decision of the manager in influencing the course of operations of the segments (Jordan et al ., 2007). 2.2.3 - Results Finding Model The models of allocation of expenses and results stemming from the options chosen on the distribution (or not) and indirect costs of integration (or not) the cost of equity in the results (Rodrigues e Simões, 2008). Direct expenses are considered those who can easily and objectively be allocated to a particular object of value, identifying themselves with a high degree of accuracy the level of use or consumption of the resource base of the expense involved (Rodrigues e Simões, 2008). Segundo Rodrigues e Simões (2008),There are two major models for the clearance of segment results:

"If there are expenses, someone has to pay them" , is the logic underlying the absorption model, where the aim would be to incorporate all costs into the product. This vision would be somewhat adjusted in a production economy where the "producer tells", but with the market set the prices to be charged and a highly competitive price, no longer makes sense to accumulate the expenses in products, once that its pricing does not come from their expense, but market forces. The cost of the product is more a consequence of how each company is organized and works. The focus of economic and financial information is then on the market in order to know their true sources of value (Rodrigues e Simões, 2008). The results obtained by the absorption model is more a consequence of the criteria used for allocation of expenses, than the true contribution of each segment. The segments that use more intensively the basis for charging will be used to hit with the largest amount of common expenses. We can consider the resulting information as information for indecision (Rodrigues e Simões, 2008). The absorption model, as well as involve the absorption of total spending by segments, still tend to ignore the capital employed in segments. For a correct assessment of the profitability of the segments, you can not ignore the value of capital employed, ie the economic value of assets related to the segment. The more correct to do so will be enlisting the burden resulting from the application of capital in economic assets, as expenses of the segment. The costs of implementation of capital are valued by the cost of capital for the organization, obtained by calculating the weighted average cost of borrowed capital and cost of capital. Not being the cost of equity recognized by the financial accounting, the "results" of the segments calculated in this way will not be compatible with the accounting organization, but with the corresponding residual result (Rodrigues e Simões, 2008). "The crossing of the options in relation to costing systems and the use (or not) the concept of" outcome "residual segment results in three large expenditures determination aproaches and thus the results:

(Rodrigues e Simões, 2008: 40). We conclude that among three approaches presented, the perspective of contribution will be more valid to present information to managers, focusing on the establishment of value generated by each segment, considering only the costs of its own, allowing an adequate view of economic performance of each segment. "In summary, rather than determine the outcome for each segment, the organization of results about the determination of the contribution margins (per segment) aims to determine the levels of contribution of segments for shared expenses, ie those that have to be supported in pursuit of support for multiple segments (accounting, quality, human resources, etc.). without which would endanger the organizational goals and business continuity." (Rodrigues e Simões, 2008: 41). The analysis by segment using the contribution approach, means that all factors related to the segment (eg, design, market, distribution channel, product range) is allocated economically and financially, regardless of function. Similarly, factors that do not relate to the segment will not be assigned, otherwise it would distort the true knowledge regarding its contribution to the results. It is assumed therefore that the segments (Jordan et al., 2007):

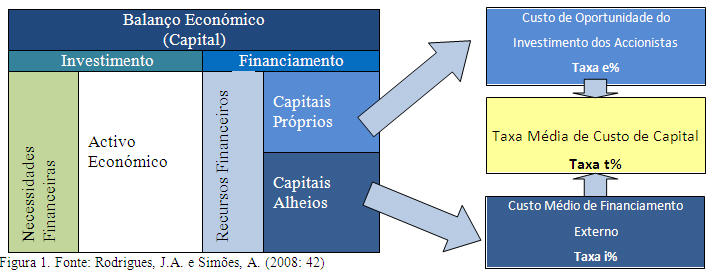

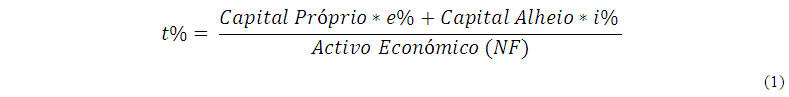

The organization of results about the clearance of their contribution margins, is to know the levels of contribution of each segment for the expenses they are common, particularly those relating to support activities that are used by multiple threads, interesting manage and control rather than distributing these costs (Jordan et al., 2007). 2.2.4 - The Capital Cost The operation in a given segment involves making investments in non-current assets and current assets (extending credit to customers, provide a certain level of stocks, among others), which can be offset by credits obtained from suppliers (current liabilities). The net investment allocated to the segments is called the Assets or Economic Capital and brings the company to pay a capital cost, which applied to the investment allocated to the segment will allow the establishment of direct financial expense (Rodrigues e Simões, 2008). To cover financial needs arising from the level of investment in economic assets, the entities have to rely on sources of financing in capital markets, which may be supported on the shareholders (equity) or other lenders (bank loans, bonds, among others) behaving, each of them a level of risk and expense. Investors have expectations of profitability for their capital in the face of alternative options (opportunity cost), while the creditors require a certain level of remuneration which is the interest (Rodrigues e Simões, 2008). Factors that influence the rate of cost of capital (t%)

Where e% identifies the expected return rate to the shareholder and i% the rate to apply for external funding. |

|

||||||||||||

nunofonseca.com - All rights reserved.