| ||||||||||||||

| ||||||||||||||

|

|

3.3 - The Programs and its Accounting Treatment 3.3.1 - Background The amount of programming produced internally by a television station varies from company to company, however, the general broadcasts programs produced by others, such as movies, series, soap operas, animation or other types of programs. When a company buys a television program, in fact, purchase the right of the display for a period of time. Among other details, the main elements of a contract of transfer of rights are: title, duration of license, number of programs, pricing, payment model and mode of delivery (Pringle and Starr, 2006). The right to display a television show is usually marketed in two ways, as the number of views (run):

A first problem is immediately on the recovery of the amortization of investment in the program to be awarded in each view. Many programs, such as movies, are usually sold in packets, ie, the rights to broadcast films n are vested jointly in a single contract. The recognition of expense will be held at the time of viewing the program. 3.3.2 - FASB Statement 63 - Financial Reporting by Broadcasters In the U.S., by 1975, accounting practices associated with television programs varied widely. Many companies were not included in their balance sheets the program rights or responsibilities related thereto. This year, the AICPA - American Institute of Certified Public Accountants - issued a statement in order to standardize practices in this industry. These practices were formalized in 1982 with the publication of FASB Statement 63 - Financial Reporting by Broadcasters "by the Financial Accounting Standards Board (Vogel, 2007). According to the standard "FASB Statement 63," the licensee (who acquired the television rights) should record an asset and the liability incurred at the beginning of the period of validity of rights, when all the following conditions are met:

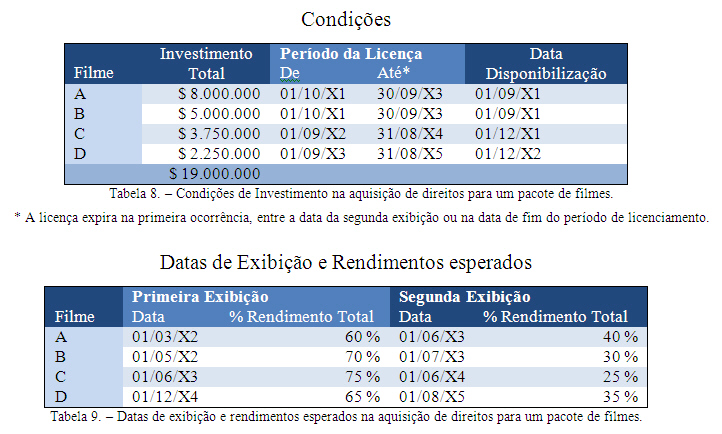

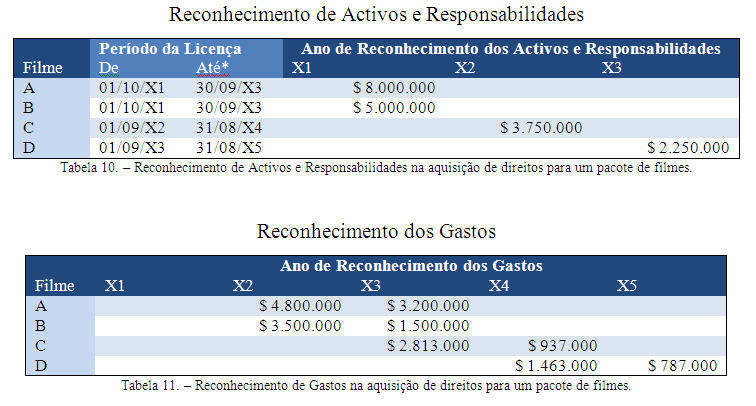

The asset (right to view the program) should then appear on the balance sheet as current or not current according to the prediction of use. Liabilities should be recorded as current or not current, according to the terms of payment. Costs should be allocated to individual programs on a package, based on the value of each to the television station, which must be specified in the contract. The investments will be amortized based on estimated number of views, except for programs with unlimited number of views, as cartoons or programs with similar characteristics, which must be amortized over the period of validity of rights, since the number of views may not be possible to determine. For programs with multiple views, the first view is more valuable to television that the following should be adopted as the declining balance method of depreciation. However, it is expected that all views to generate the same income should be adopted the method of depreciation by constant rates. The value of the rights to the balance sheet should be the lower of unamortized cost and estimated net income. If the earning potential of a program is revised downward, should be required to reduce (write down) the unamortized cost for the value of expected net income. Example adapted from FASB Statement 63, applied to the purchase of a package of films: Assumptions:

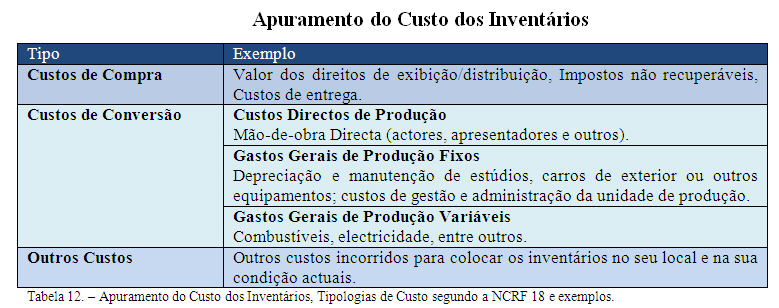

3.3.3 - NCRF 18 - Inventories Not being found in Portugal, or the European Union, a specific regulatory framework for implementing the accounting treatment of television programs, should be applied to Standard Accounting and Financial Reporting 18 (NCRF 18), which is based on International Accounting Standard IAS 2 - Inventories as adopted by Regulation (EC) No 2238/2004, the Commission of December 29. "A key aspect in accounting for inventories is the amount of cost to be recognized as an asset and carrying until the related revenues are recognized. This Standard provides practical guidance on determining the cost and its subsequent recognition as an expense including any adjustment to net realizable value. It also provides guidance on the cost formulas that are used to assign costs to inventories. " (NCRF 18). The NCRF18 believes that inventories are assets: (a) held for sale in the ordinary course of business, (b) in the process of production for such sale or (c) in the form of materials or supplies to be used in the production process or in service delivery. Being a television purchased or produced during the operation of a television station, with a view to obtaining income through its distribution, fits this definition, is classified as inventory. This inventory can be held for sale - for example, when yields are obtained through direct consumer sales of DVD's - or consumed in providing services to third parties - for example selling advertising space in programs. A television broadcast will be correctly classified if it is considered a service, or set of services, usually for entertainment or information. Consumers of these services can be many. Taking the example of a subscription channel with marketing of advertising space, we have two services: one to another subscriber and the advertiser. The programs will be consumed in the course of this service. Inventories encompass not only the finished programs, as well as programs in production and include materials and supplies awaiting use in the production process. In accordance with paragraph 9 of NCRF18, inventories should be measured at cost or net realizable value, whichever is lower. On the net realizable value means the net amount that the entity expects to realize from the sale of inventory. "The cost of inventories should comprise all costs of purchase, costs of conversion and other costs incurred in bringing the inventories to their present location and condition." (NCRF 18) The conversion costs are composed directly related to production, such as manpower or direct the allocation of production overheads - fixed and variable - incurred in converting materials into finished goods. The fixed production overheads are those indirect costs of production that remain relatively constant regardless of production volume, for example, depreciation and maintenance of buildings and equipment of production facilities and the costs of managing and administering those units. For variable production overheads means the indirect production costs that vary directly (or almost) with the volume of production, for example, indirect materials.

The allocation of fixed production overheads to the costs of conversion is based on the normal capacity of production facilities, namely that the average output is expected to be achieved under normal circumstances, considering the loss of capacity resulting from planned maintenance. Where the production falls short of normal capacity provided, the amount of fixed production overheads allocated to the inventory will not be increased, and the Unallocated overheads recognized as an expense in the period they are incurred. Conversely, if the production of a period is higher than expected, the amount of fixed production overheads allocated to each unit of production will be decreased so that inventories are not measured above cost. The variable production overheads are allocated to inventory based on the actual use of production facilities. In accordance with paragraph 21, the standard cost method can be used to measure the cost of inventories, taking into account normal levels of materials and supplies, the manpower, efficiency and capacity utilization. These should be regularly reviewed and, if necessary, should do so in light of current conditions. Assets should not be carried at amounts greater than can be expected to result from their sale or use. Thus, resulting from changes in market conditions or other reasons, if the estimated sale value is less than the cost of inventories, will be consistent with this view reduce the cost of inventories ( write down ) to net realizable value. The carrying amount of inventories is recognized as an expense in the period in which the related revenue is recognized. The amount of any resulting adjustment of inventories to net realizable value shall be recognized as an expense in the period when the adjustment occurs. 3.3.4 - Other Considerations The regulatory framework discussed in the previous accounting treatment is aimed at under television stations, buying or producing content for the principal purpose of the distribution / issue in its regular business. Not being the target of this work for companies producing movies or television, aimed at creating and developing content for the purpose of licensing to third parties, the guidelines will be different, should be considered NCRF 6, based on IAS 38 - Assets Intangibles, adopted by Regulation (EC) No 2236/2004, the Commission of December 29. |

|

||||||||||||

nunofonseca.com - All rights reserved.