| ||||||||||||||

| ||||||||||||||

|

|

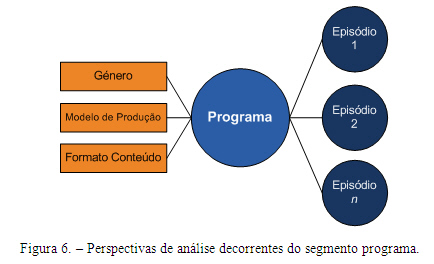

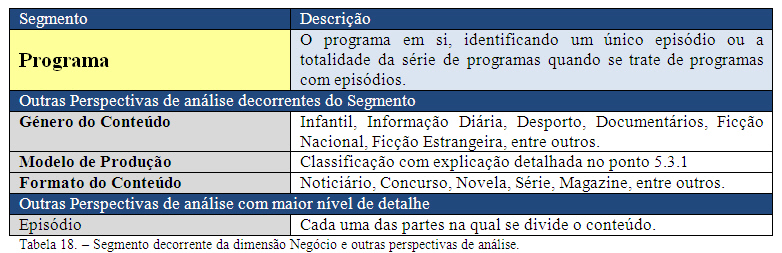

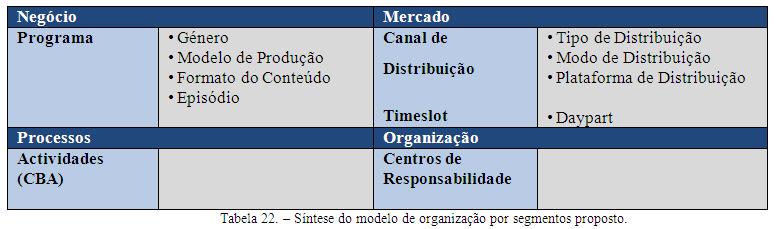

5.2 - Segmented Analysis The definition of segments is to provide a multi-dimensional analysis on the various critical lines of business. Aiming to know the sources or destructive of value and conduct economic and financial monitoring on a more efficient management, it is proposed in this paper, a segment model based on the four dimensions introduced by Rodrigues, J. A. and Slater, A. (2008): Business, Marketing, and Organizational Processes. The segments and the various analytical perspectives proposals aimed at meeting the information needs of the new context of the television market, considering the content and the various ways to reach the consumer, ensuring the manager an overview of the business of a multi-platform . Business Dimensions In the television market products are the content, or programs. The program is the main target of investment and the generation of income in this business becoming thus a fundamental review of their performance in order to know which, and to what extent they create or destroy value. Beyond the program itself, an analysis by episode (if any) will also be important to allow evaluation of different performances between them. Some attributes concerning the programs are also important analytical perspectives, it will understand different performances according to the shape and type of programs. It could be an analogy here, for example, with product lines in other industries. From a standpoint of business is proposed then the model of analysis:

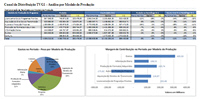

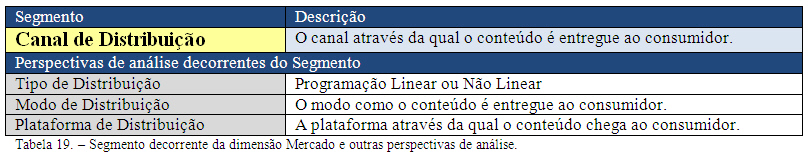

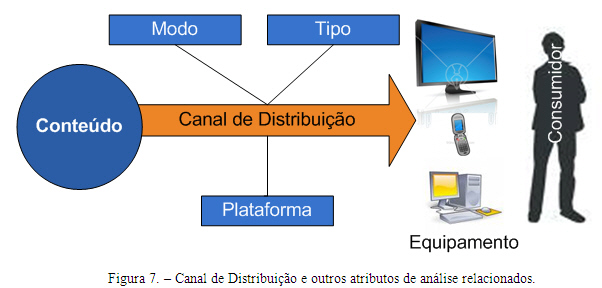

Market Size Of a multi-platform, with multiple ways of getting content to consumers, reveals itself as the fundamental analysis of the distribution channel of content. Is the distribution of content that will generate revenue from them. On the other hand, is the distribution that will give the consumer the stock of content will represent an expense. Knowing the capacity of each distribution channel to generate or destroy value for the business is so vital. It should be remembered that the majority of licensed content for TV has a limited number of distributions (limited views on linear programming). So we need to maximize the performance of each view, the option selected distribution as a critical success factor. Other analytical perspectives related to distribution are also relevant. A distribution channel uses a distribution platform to deliver content to consumers. Will therefore be important to obtain a comprehensive view of performance of the various channels grouped by distribution platform. The type and mode of distribution will also be important lines of analysis.

The distribution channel is in this perspective, the main axis of analysis, being released under a distribution platform that can enable various modes and types of distribution. The Platform for distribution, the mode of distribution and the type of distribution appear as attributes of the distribution channel.

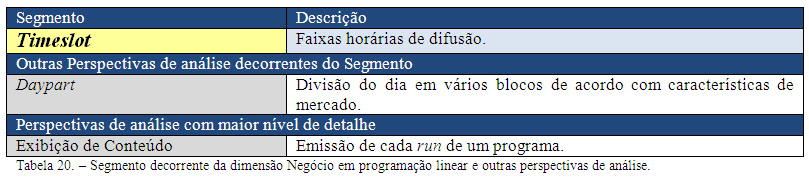

Regarding the linear distribution - broadcast channels broadcast - there own characteristics, from which emerges a single axis of analysis in this transmission model and critical to business, based upon diffusion. The various times of diffusion are not repeated, so it is essential to assess the performance of various times of day used to deliver content in order to know whether they were or were not generating business value. If not linear in distribution is the consumer who decides the time of consumption on linear programming to maximize the performance is to transmit the content in the most propitious time to get the desired audience and maximize revenue. Note that the maximization of income is not achieved simply by maximizing the audience, but with the conquest of its most profitable segments. This point of analysis is essential to assess the performance of a program schedule and may be divided by slots (timeslots) and grouped daypart, ie different parts of the day set according to market characteristics. Apart from some moments of diffusion in linear programming, can import evaluating the performance of each distribution of content, it will be through this that will generate income and spending and, as already mentioned, in most cases contracted the rights to display of a program are purchased in limited numbers.

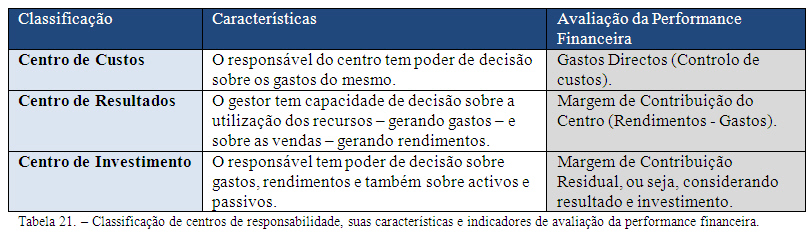

As this segment due to the specificity of linear programming, that can be implemented properly, will also cover the non-linear programming. Will then be added valuables which include income and expenses of such distribution. Dimension Processes Traditional systems of allocation of expenses may lead to distortions resulting from the allocation criteria chosen. Among other limitations, focus on ways of allocating spending, placing little emphasis on resource management and control of its profitability and use arbitrary allocation keys based, for example, in the quantities produced without taking into account the real factors leading to spending. As an alternative to this model comes the CBA - Activity Based Costing. This model is based on the concepts of process and activity, allowing you to assign high accuracy levels of consumption of resources to processes and activities. The costs are primarily attributable to activities, which are then allocated to other items of value: activities consume resources and products derived from activities (Jordan et al., 2007). CBA is not the subject of this dissertation, it is recommended that this model not only as a way to improve the financial reporting of the company but also as a contribution to improving the competitiveness of the organization. Through business process reengineering the CBA may lead the organization to a more efficient use of resources and hence improved profitability. Organizational Dimension Not wishing to dedicate this work to a comprehensive study on the responsibility centers, it is understood that this is the most appropriate model for the organization of financial information on the organizational dimension, especially for application to UNC. According to the model presented by Jordan et al. (2007), centers of responsibility can be classified as shown in the table below and in accordance with the decision power of the center manager:

The UNC will be responsible as a manager whose decisions regarding the distribution of content will generate spending and income. Moreover, this charge will also take decisions regarding the acquisition of content (investment) and the associated business models, for example, terms and conditions of payment or receipt. Therefore, decide on a set of features that translate in terms of financial assets and liabilities. The content of each stock UNC will be part of its assets. Can therefore be classified as a UNC an investment center. Summary We can summarize the proposed organization of segments and other relevant perspectives of analysis, as follows:

|

|

||||||||||||

nunofonseca.com - All rights reserved.