| ||||||||||||||

| ||||||||||||||

|

|

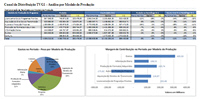

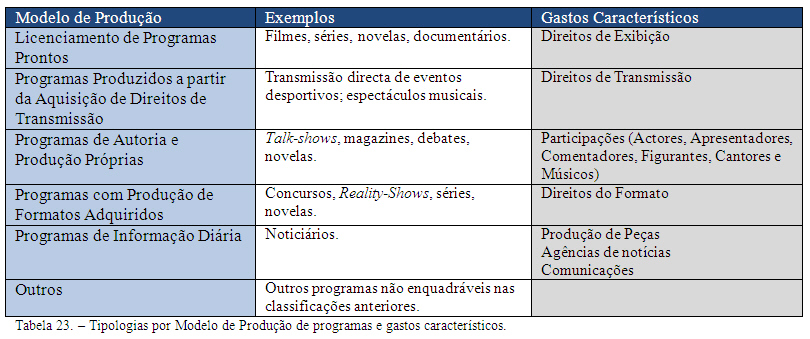

5.3 - Segmented Expense Recognition Were previously introduced some features of this business. First, broadcast on the increasing number of consumers does not increase spending, ie spending will be the same there are ten people to attend a program or a million. On the other hand, having no physical existence and content can be distributed in digital form - the content can be delivered to consumers as there are many who wish to do (here ignore the constraints of bandwidth and other technological constraints) - the traditional concept Inventory gains a new meaning. With these features, without an actual physical consumption and measurable as found in most businesses where the stock was effectively reduced by sales, the business model of digital content puts the focus on the period during which content can be distributed and the number of times it can be shown on broadcast. Digital content to be added yet another feature, new content can incorporate parts of others without the original if they spend (sounds, images, videos, etc.). In this context, this paper attempts to address the expense of intangible products, trying to present the main problems encountered and propose solutions. In allocating income and expenses to the segments will use the model of the contribution. This model, presented in detail in the theoretical component of this work, it was concluded as the most valid for the organization of information, among other factors, not to distort the costs of each segment through the allocation of common expenses (and other support activities) based on arbitrary criteria, which directly influence the results determined and dependent on the basis of allocation used. Therefore, only the direct expenses of each segment will be charged, putting the focus on the value generated by each segment and its contribution to the common expenses. This model also includes the cost of capital used by the economic assets of each segment. 5.3.1 - Allocation of Expenses to Content There are several types of programs that result, among other characteristics, the type of content and form of production. This section attempts to distinguish various types of programs and propose a classification called Production Model. Are intended to identify this classification various models of program production, according to your spending, and propose specific allocation of these where appropriate. Ready Program Licensing Many of content distributed by the television companies are purchased from third parties, typically large international producers that sell movies, series, soap operas, documentaries and other programs. The television company acquires the right to display the program for a period of time and usually limited by a number of exhibitions. The value of licensing will therefore be spending more relevant for this type of content. Added to this amount may be other expenses related to treatment and location of the content (subtitling, dubbing, etc.). It should be noted that, often, licensing contracts are not only relate to a program, but a package, for example, several movies or series. Programs Produced from the Acquisition of Broadcasting Rights Many television shows have content by the broadcast, usually live, events, for example, sporting events or music concerts. This model differs from the licensing of programs ready in the sense that the company does not acquire a television program "done" but the right to collect the images and transmit the event. All production of content and related expenses will generally be provided by television company. In this model fits the usual broadcast of football matches. The rights are generally sold in package, for example, competitions, championships, tournaments, among others. The value of media rights is generally a large share of the expenses associated with this type of content. Where the contract for the purchase of rights does not specify the value of each event and covering various events, the distribution should be held equally by the number of events. If the potential income to be obtained in each of the events pertaining to register notable asymmetries should be used as the proportion of expected income for the allocation of costs among the various events. Authoring and Production Own Programs Fit into this model all programs produced by the company whose format is yours. Since its author is not due rights to others. Programs such as debates, talk shows or talk shows usually fall into this model. The main expenses related to this type of programs, in addition to technical production, may be related to equity, for example, actors, presenters, singers, musicians, reviewers, or others. There may be stock or related rights arising from the use of music, images or other elements. Programs from Purchased Formats Production In many situations, the television companies to third parties acquire the right to produce and transmit certain program formats. The level of involvement from the copyright holder in production may be variable. This model can apply, for example, contests or reality shows, can also occur in the local production of series or novels originally created by other companies. Expenses relating to the rights relating to the format in this model may have a relevant importance. Daily News Programs The daily news programs, commonly known as news, have particular regard to other programs. Most TV stations transmit several newscasts throughout the day including parts / or edited reports produced by the station. The various newscasts throughout the day just as well, to include the same pieces, although they can be changed. The pieces of news have mostly originated from reports made to agencies or images / international channels such as CNN or Reuters. The expenses associated with them are related to production (human resources, equipment, travel and other) or the amount charged by agencies / channels, usually in the form of periodic fees (annual, quarterly, or others) may, occasionally, Are there other models. Given the characteristics presented, it would make sense to establish the expense of such programs by individual daily news, since the same content is shared among several programs. Any arbitrary distribution inevitably lead to wrong conclusions. It is therefore proposed to allocate these expenses to a subject of funding, the program segment called "Daily Information - Common" that aggregate all these common expenses. In the production of news programs daily spending on communications are representative, including those for satellite transmissions. When communications are aimed at sending parts or other activities not directly related to any program specifically related expenses should follow the model presented earlier. In the case of direct reports in a newscast for specific expenses should be allocated to the program as intended. Another feature distinguishes this type of program the other: the governance of the production of news programs daily, unlike the others, fits a particular model of operations management rather than project management. Summary In summary, when the expenses involve more than one program, multiple events or episodes, which is not individually identifiable value assigned to each, must be apportioned equally among all programs / episodes involved. As exceptions to this rule is proposed:

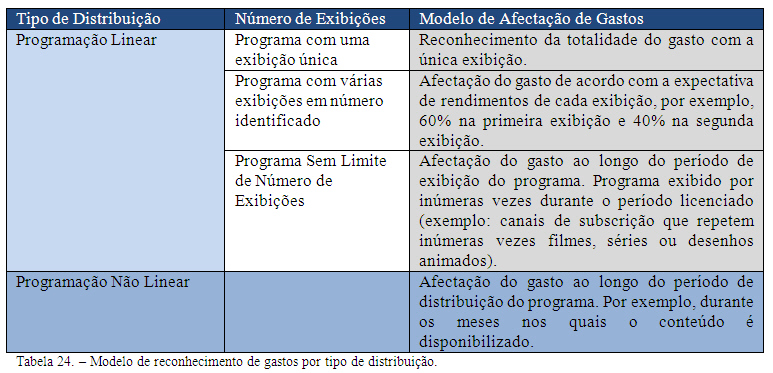

5.3.2 - Effect and Recognition of Expenses With Content Delivery The costs associated with content are viewing rights, broadcasting rights or any other, should be recorded as inventory, since, in accordance with IAS 18, represent assets held for sale in the ordinary course of business activity and consumables to applied in providing services. The expense will be recognized and assigned to objects of value to the distribution of content, this is your view on a channel issue or making available via video-on-demand. Being associated with income distribution, this solution is in line with IAS 18, ensuring the recognition of expenses in the period in which revenue is recognized. In the licensed programs that are based on the licensing of one format or media rights and a multi-platform, multi-channel distribution, in which the company intends to distribute content, must be present in the negotiation of licensing and can be properly identified figures for each platform in the contract. Whether to issue a broadcast channel model is associated with habitual purchase the number of views for other channels of non-linear programming model that would not have felt it might be related to the number of consumers and / or distribution period. By distributing a program spending should be recorded in the various segments in accordance with the proposal: Programme, distribution channel, timeslot and responsibility center. Not being the subject of the proposed value of the common expenses of a Daily Information program itself, its expense would be recognized every day, since in principle every day are allocated for such programs. Implementing NCRF 18, inventories should be measured at lower of cost or net realizable value. Thus, as a result of changes in market conditions, if the value of the cost of a program exceeds the revenue potential expectable with the program, the cost should be reduced inventories (write-down) to net realizable value. This may occur, for example, the existence of any reason that leads to loss of interest and potential audience of a program. The occur an adjustment of inventory to net realizable value, the amount should be recognized as an expense in the period in which the adjustment. Recognition of Expenditures Content with Multiple Views Content can be displayed several times in linear programming, it would make sense to recognize all of its expenses with the first exhibition / distribution, since that will generate income in each view. The expense should be recognized in proportion to the income expected from each view. In nonlinear programming, in principle, there are no constraints on the number of distributions, the main limitation being the period during which the content can be distributed. Responding to the characteristics of two types of distribution, we propose the following model for recognition of expenses:

Recognition of Expenses for Distributed Content in Multiple Distribution Channels In the segment distribution channels expenses should be apportioned according to the expected income for each channel, or any necessary expenses directly related to the distribution channel should be recorded exclusively on their channel. Recognition of Expenses in the segment timeslot Expenses pertaining to content at its distribution, should be allocated in proportion to the timeslots that are distributed. Assuming a program beginning at 19:45 display and end at 20:45, the allocation of expenditures should be: 19:00 to 20:00: 25%; 8:00 p.m. to 9:00 p.m.: 75%. |

|

||||||||||||

nunofonseca.com - All rights reserved.